Canadian Dollar Exchange Rate: Fluctuations in Iran’s Currency Market

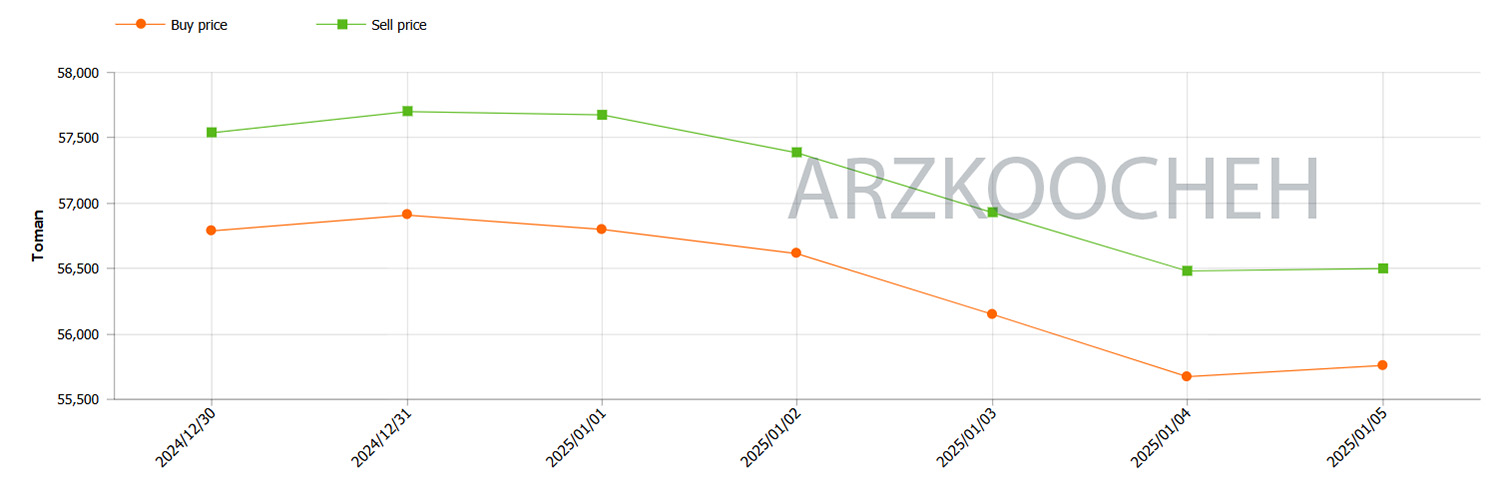

Sunday 5 Jan 2025The Canadian Dollar (CAD) has experienced notable fluctuations against the Iranian Rial (IRR) in recent days. According to real-time data from Arz Koocheh, the buy and sell prices of CAD have shown a steady downward trend over the past week. This trend reflects various economic and geopolitical factors shaping Iran’s currency market.

Why Are Canadian Dollar Exchange Rates Fluctuating?

One of the main reasons behind the recent shifts is the active intervention of Iran's currency market regulators. The injection of petrochemical revenues and the central bank’s stabilization efforts have helped manage the volatility. While no formal FATF negotiations have commenced, positive signs of Iran's willingness to engage in these discussions have contributed to cautious optimism among market participants.

However, global geopolitical tensions, including reports from Western media about the potential for military actions against Iran, have created uncertainty in the currency market. This has had a direct impact on exchange rates, causing fluctuations in the value of foreign currencies, including the Canadian Dollar.

Analyzing the Chart: A Steady Decline

The graph provided by Arz Koocheh illustrates the week-long downward trend in CAD prices against the Iranian Rial. Both buy and sell prices have steadily decreased, with the most significant dip occurring on January 3, 2025. Despite slight recovery on January 5, the overall trend suggests a reduced demand or increased availability of foreign currencies like CAD in the Iranian market.

Is It a Good Time to Buy Canadian Dollars?

For those considering whether to invest in Canadian Dollars, timing is crucial. The current lower prices may seem attractive for purchasing CAD, especially for travelers or businesses dealing with Canadian markets. However, given the uncertainty in Iran’s economic policies and geopolitical landscape, it’s essential to proceed cautiously.

Experts recommend keeping a close eye on developments related to FATF negotiations and Iran’s monetary policies. These factors could significantly influence the Canadian Dollar’s exchange rate in the coming weeks.

Factors Influencing the Market

- Iran’s Economic Stabilization Measures: Increased injection of foreign currency by the central bank has helped manage fluctuations.

- FATF Negotiations: Although no formal talks have begun, positive signs are encouraging market stability.

- Geopolitical Uncertainty: Reports of potential military action against Iran continue to create market anxiety.

Conclusion: Navigating a Volatile Market

The Canadian Dollar exchange rate remains a reflection of the complex interplay between economic and political forces in Iran. While current prices offer an opportunity for buyers, uncertainty lingers, requiring a strategic approach to currency investments.