Currency Volatility Following Israel-Iran Conflict: Canadian Dollar Spikes Before Decline After Attack

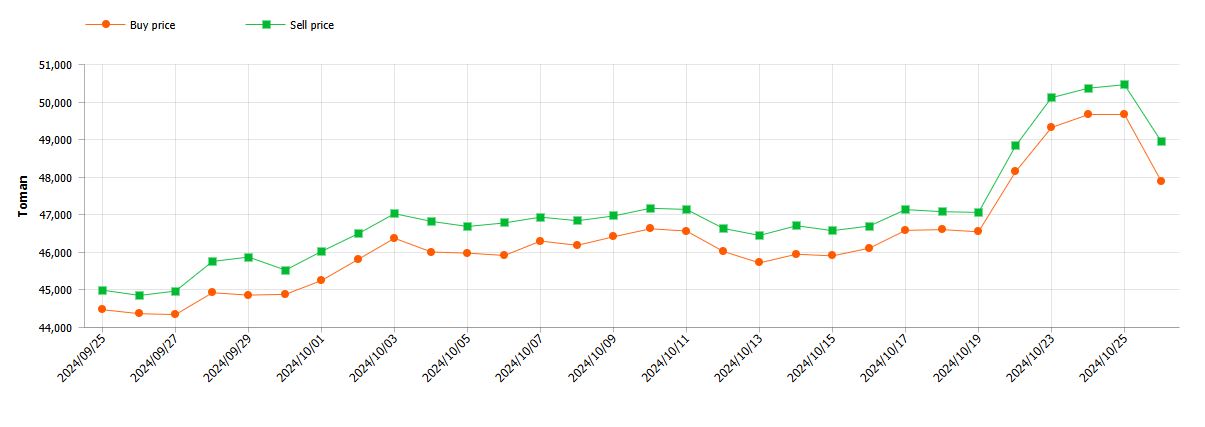

Sunday 27 Oct 2024In the days leading up to the Israeli attack on Iran on October 25, 2024, the Canadian dollar, along with other major foreign currencies, saw significant price fluctuations. Initially, starting on October 19, a surge in demand for foreign currencies occurred, peaking just before the attack. Following the conflict, however, the market began to stabilize, and foreign currency values started to decline.

On October 19, 2024, the Canadian dollar (CAD) began to rise sharply in value against the Iranian toman as speculation and uncertainty surrounded the escalating tensions between Israel and Iran. This surge in the exchange rate was driven by panic in the markets, with many investors and Iranian citizens seeking to safeguard their assets by converting tomans into more stable foreign currencies. The CAD to toman exchange rate continued to increase, peaking around 50,000 toman by October 23.

This increase was not isolated to the Canadian dollar. Other major currencies, such as the US dollar (USD) and Euro (EUR), also experienced spikes during this period. The market anticipated potential instability, and foreign currency demand surged as Iranians moved to protect their wealth from possible depreciation of the national currency.

Impact of the Israeli Attack on October 25

On October 25, 2024, Israel launched a military strike on Iran, intensifying geopolitical tensions. Contrary to what might have been expected, the market reaction following the actual attack resulted in a stabilization of currency exchange rates. After the peak that occurred before the conflict, prices for the Canadian dollar, US dollar, and Euro began to decline. This pattern suggests that the initial market panic had already been priced in by the time the military action occurred.

Post-Attack Market Correction

Following the attack, a market correction took place as demand for foreign currencies, particularly the CAD, USD, and EUR, began to subside. Investors reassessed the situation and gradually returned to local currencies or diversified their portfolios into other assets. This trend highlights the typical behavior in currency markets during geopolitical crises—initial surges followed by corrections as panic fades and market participants adjust their strategies.

Broader Impact on Major Currencies

In addition to the CAD to toman exchange rate, the USD and EUR showed similar fluctuations, spiking before the attack and then declining afterward. This suggests that while political events like the Israel-Iran conflict can drive temporary volatility, markets eventually stabilize as the situation becomes clearer.

Market Outlook

Despite the recent correction, the market remains highly volatile due to ongoing geopolitical uncertainties. Investors are closely monitoring the aftermath of the conflict, with exchange rates for the Canadian dollar, US dollar, and Euro likely to remain sensitive to any further developments between Israel and Iran.

Conclusion

The fluctuations in the Canadian dollar to toman exchange rate between October 19 and October 25, along with similar movements in other major currencies, underscore the impact of global events on the foreign exchange market. While these events can cause temporary surges in demand for foreign currencies, market corrections often follow, bringing prices back down. With continued geopolitical uncertainty, currency volatility is expected to persist.